.jpg)

When establishing a business structure in Australia, other than a sole Trader or Partnership entity, there are two common options are available which are essentially either setting up a company or setting up a trust. Each structure serves different purposes and comes with its own setup requirements, benefits, and potential drawbacks. The right choice depends on your business goals, risk profile, and long-term plans.

There are a number of different types of Trusts, so it is very important that you discuss your requirements and intentions with us first to the right advice to suit your circumstances.

If you are thinking about either of these then you should book an appointment to discuss the pros and cons of

each.

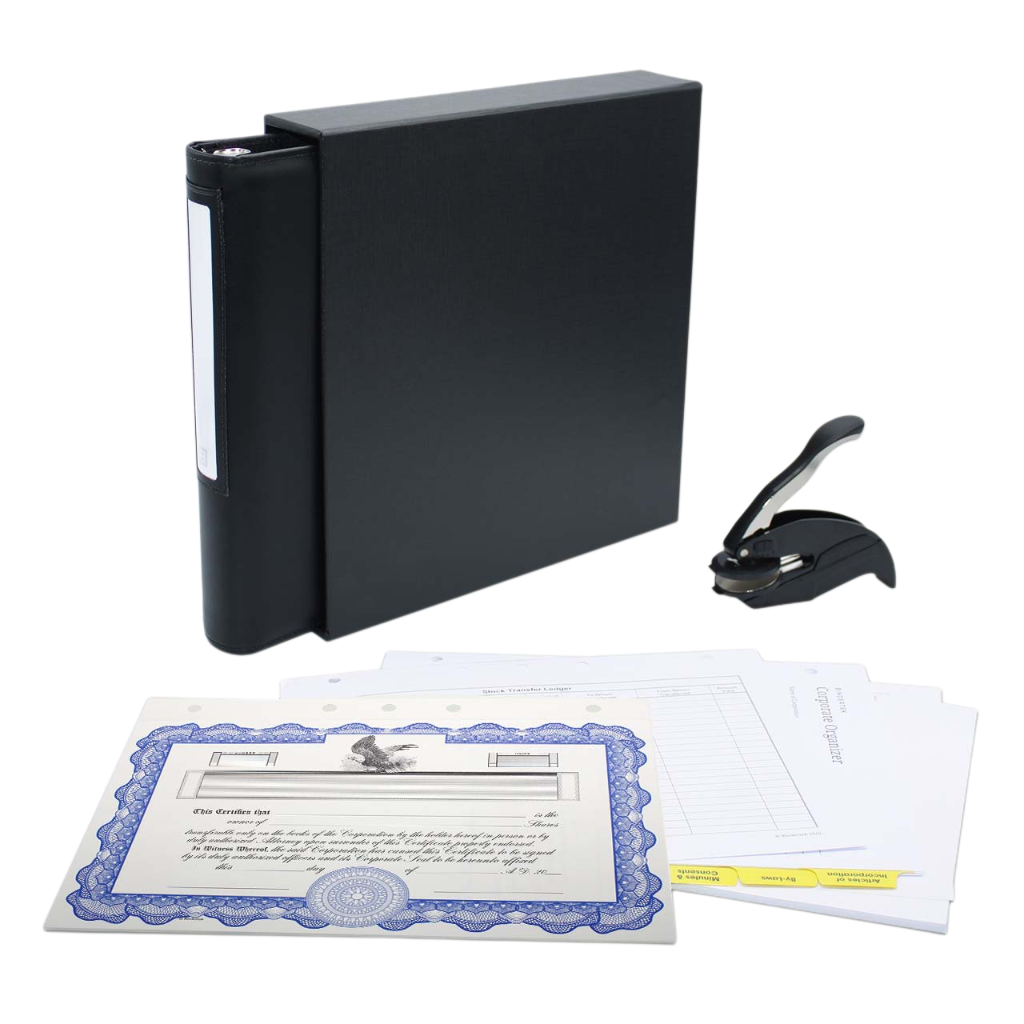

A Company is a separate legal entity, governed by the Corporations Act 2001, and is registered with ASIC (Australian Securities and Investments Commission).

Some advantages:

Some disadvantages:

.jpg)

A Trust is a structure where a trustee holds and manages assets on behalf of beneficiaries. Commonly used types include Discretionary Trusts (family trusts), Unit Trusts (fixed & non-fixed) and in somes situations Hybrid Trusts.

Some advantages:

Some disadvantages:

As your ASIC Agent you would be authorising Oracle Accounting & Wealth to act on behalf of your company in its dealings with the Australian Securities and Investments Commission (ASIC). In so doing Oracle Accounting & Wealth would manage Corporate Compliance on your behalf. Some tasks we can look after for you are as follows:

Acting as your ASIC Agent is a valuable service to help ensure you meet your legal

obligations efficiently and accurately.